Founded in 1905 to solve the emerging famine in Europe, Yara today is one of the world’s largest nitrogen manufacturers, with about 17,000 employees and operations in over 60 countries. Last year, the Norwegian-listed company reported sales of almost €11bn, profits (EBITDA) of €1.3bn sold more than 28m tonnes of fertiliser and has a stock market valuation of €10bn.

But for such a global business, Nicholas Morrison, business manager for Yara in Ireland, says it is very much a local business working with local distributors and farmers. In 2009, Yara had only two people on the island of Ireland. Today, it has more than 10 following a decision to invest in local markets in 2010.

Having successfully built a business in Northern Ireland out of its Belfast site, Yara invested in a site in Ringaskiddy, Co Cork, in 2016. Morrison says this was an important strategic move as it ensured a local footprint, demonstrating the company’s commitment to developing its brand across Ireland. He says the company has been committed to building demand for its products through engagement with farmers and providing tailored solutions.

Environmental impact

The company mission according to Morrison is to “responsibly feed the world and protect the planet”. He says fertiliser has contributed to the world being able to continue to feed itself over the last century.

However, Morrison is aware of the environmental impact of fertiliser production and application – particularly regarding greenhouse gas emissions, notably carbon dioxide (CO2) and nitrous oxide (N2O). Morrison says Yara has already made large improvements in this area, and will continue to improve to meet its carbon intensity targets.

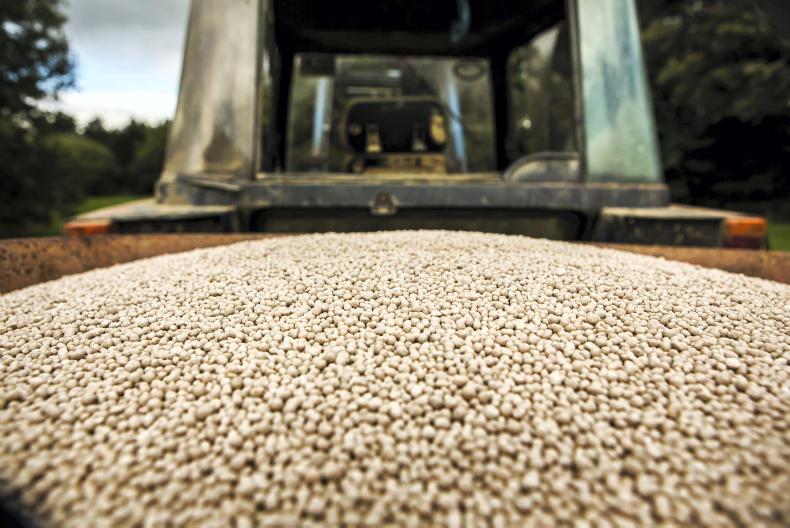

\ Philip Doyle

Overall, the European fertiliser industry has reduced its greenhouse gas emissions by more than 40% since 2005. And Yara aims to go further to reduce its greenhouse gas intensity per tonne of fertiliser produced by another 10% by 2025.

Nitrate-based fertilisers such as ammonium nitrate (AN) and calcium ammonium nitrate (CAN) are the most common source of nitrogen in Europe, have the lowest ammonia (NH3) emissions when applied, which will explain why most EU countries are adopting nitrates over urea type products. .

Fertiliser Europe, the industry body representing fertiliser manufacturers, says European plants are the most-energy efficient and have the lowest carbon footprint of the industry globally. Yara offers low-carbon nitrate fertilisers through technology it has installed in its nitric acid plants. This technology can reduce these harmful emissions during the production process by as much as 90%.

This technology was developed by the company and has since been shared with the rest of the industry. It is today part of the “best available techniques” (BAT) for fertiliser production as defined by the EU.

One of the areas the company is interested in is reducing emissions at field level, says Morrison. He says that Yara has not gone down the stabilised urea route where chemicals such as NBPT are applied to the granules. He says have reserved judgement on the stabilised urea route for grassland, where chemicals such as NBPT are applied to the granules, due to the lack of long-term trial data set for grassland. He says the company have other options which are complete compound fertilisers (CCF) that combines sulphur with nitrogen to reduce ammonia emissions.

Product quality

Yara has 30 sites all around the world that produce high-quality products, from urea to micro nutrients. He says this infrastructure provides supply security, consistency and flexibility to customers. Morrison says the company prides itself on the use of the best raw materials. He says it specialises in complex compound fertilisers as opposed to blends (which make up the majority of the market). While these are more expensive to produce, he believes they are a premium product.

Innovation

“We are committed to R&D,” says Morrison. More than a decade ago, Yara pioneered digital farming by developing the N-sensor; a tractor-mounted sensor that analyses the nutrient level in the field and adjusts fertiliser application in real-time. Since then, additional technology has been made available in hand-held devices and apps on smartphones, such as the N-Sensor BT which allows farmers to take readings in a growing crop in order to establish its nitrogen content.

One idea that is more futuristic involves building the world’s first battery-driven, zero-emission and autonomous container ship to improve its logistics.

Farmer focus

Over the past few years, Yara has moved to a more customer-centric approach towards farmers. Morrison says that “while we invest to improve and innovate our production systems, much of our efforts are focused on launching new products that respond to the needs of farmers”.

He says the company’s interaction with farmers provides important insights and knowledge that can be transferred back to the company.

Most other major fertiliser players are production-focused, with limited in-market presence and farmer interaction, and the players with market presence do not have global reach, according to Morrison.

Morrison adds that “A key piece in the business model for Yara in Ireland are our network of distributors who provide a strong link between Yara and farmers.

“Our distributors know their farmers and their needs and feed back to us what farmers require when it comes to crop nutrition.

“In order to make it easier for our midland distributors to better service their farmers with our fertilizer we will open a new inland store at Roscrea, Co. Tipperary in January 2020.

“This move will allow midland distributors to have easier access to our fertiliser instead of travelling to Ringaskiddy.”

Natural gas is Yara’s main raw material and also represents its largest variable cost but it is crop prices that are the usual suspect when it comes to explaining fertiliser price moves. Morrison explains that the price of fertiliser is more driven by the global price of urea and what China does than local energy prices. He says the supply–demand balance of global urea is a large driver of price of nitrogen in Europe. He adds that prices remain firm at the moment and it does not look like nitrogen will be more expensive than in 2019.

He sees stronger environmental regulations as a driver for business opportunities. “Agriculture is a major source of greenhouse gas emissions and solutions will be needed to combat soil degradation, and nutrient losses to water and air,” according to Morrison. He says that farmers and the food industry are seeking a deeper engagement in their supply chains, and Yara is anticipating this will change how farmers buy and apply fertilisers. He believes that by using Yara’s proven low-carbon fertilisers and best farming practices, the carbon footprint from crop production can be significantly reduced, while maintaining yields.

Founded in 1905 to solve the emerging famine in Europe, Yara today is one of the world’s largest nitrogen manufacturers, with about 17,000 employees and operations in over 60 countries. Last year, the Norwegian-listed company reported sales of almost €11bn, profits (EBITDA) of €1.3bn sold more than 28m tonnes of fertiliser and has a stock market valuation of €10bn.

But for such a global business, Nicholas Morrison, business manager for Yara in Ireland, says it is very much a local business working with local distributors and farmers. In 2009, Yara had only two people on the island of Ireland. Today, it has more than 10 following a decision to invest in local markets in 2010.

Having successfully built a business in Northern Ireland out of its Belfast site, Yara invested in a site in Ringaskiddy, Co Cork, in 2016. Morrison says this was an important strategic move as it ensured a local footprint, demonstrating the company’s commitment to developing its brand across Ireland. He says the company has been committed to building demand for its products through engagement with farmers and providing tailored solutions.

Environmental impact

The company mission according to Morrison is to “responsibly feed the world and protect the planet”. He says fertiliser has contributed to the world being able to continue to feed itself over the last century.

However, Morrison is aware of the environmental impact of fertiliser production and application – particularly regarding greenhouse gas emissions, notably carbon dioxide (CO2) and nitrous oxide (N2O). Morrison says Yara has already made large improvements in this area, and will continue to improve to meet its carbon intensity targets.

\ Philip Doyle

Overall, the European fertiliser industry has reduced its greenhouse gas emissions by more than 40% since 2005. And Yara aims to go further to reduce its greenhouse gas intensity per tonne of fertiliser produced by another 10% by 2025.

Nitrate-based fertilisers such as ammonium nitrate (AN) and calcium ammonium nitrate (CAN) are the most common source of nitrogen in Europe, have the lowest ammonia (NH3) emissions when applied, which will explain why most EU countries are adopting nitrates over urea type products. .

Fertiliser Europe, the industry body representing fertiliser manufacturers, says European plants are the most-energy efficient and have the lowest carbon footprint of the industry globally. Yara offers low-carbon nitrate fertilisers through technology it has installed in its nitric acid plants. This technology can reduce these harmful emissions during the production process by as much as 90%.

This technology was developed by the company and has since been shared with the rest of the industry. It is today part of the “best available techniques” (BAT) for fertiliser production as defined by the EU.

One of the areas the company is interested in is reducing emissions at field level, says Morrison. He says that Yara has not gone down the stabilised urea route where chemicals such as NBPT are applied to the granules. He says have reserved judgement on the stabilised urea route for grassland, where chemicals such as NBPT are applied to the granules, due to the lack of long-term trial data set for grassland. He says the company have other options which are complete compound fertilisers (CCF) that combines sulphur with nitrogen to reduce ammonia emissions.

Product quality

Yara has 30 sites all around the world that produce high-quality products, from urea to micro nutrients. He says this infrastructure provides supply security, consistency and flexibility to customers. Morrison says the company prides itself on the use of the best raw materials. He says it specialises in complex compound fertilisers as opposed to blends (which make up the majority of the market). While these are more expensive to produce, he believes they are a premium product.

Innovation

“We are committed to R&D,” says Morrison. More than a decade ago, Yara pioneered digital farming by developing the N-sensor; a tractor-mounted sensor that analyses the nutrient level in the field and adjusts fertiliser application in real-time. Since then, additional technology has been made available in hand-held devices and apps on smartphones, such as the N-Sensor BT which allows farmers to take readings in a growing crop in order to establish its nitrogen content.

One idea that is more futuristic involves building the world’s first battery-driven, zero-emission and autonomous container ship to improve its logistics.

Farmer focus

Over the past few years, Yara has moved to a more customer-centric approach towards farmers. Morrison says that “while we invest to improve and innovate our production systems, much of our efforts are focused on launching new products that respond to the needs of farmers”.

He says the company’s interaction with farmers provides important insights and knowledge that can be transferred back to the company.

Most other major fertiliser players are production-focused, with limited in-market presence and farmer interaction, and the players with market presence do not have global reach, according to Morrison.

Morrison adds that “A key piece in the business model for Yara in Ireland are our network of distributors who provide a strong link between Yara and farmers.

“Our distributors know their farmers and their needs and feed back to us what farmers require when it comes to crop nutrition.

“In order to make it easier for our midland distributors to better service their farmers with our fertilizer we will open a new inland store at Roscrea, Co. Tipperary in January 2020.

“This move will allow midland distributors to have easier access to our fertiliser instead of travelling to Ringaskiddy.”

Natural gas is Yara’s main raw material and also represents its largest variable cost but it is crop prices that are the usual suspect when it comes to explaining fertiliser price moves. Morrison explains that the price of fertiliser is more driven by the global price of urea and what China does than local energy prices. He says the supply–demand balance of global urea is a large driver of price of nitrogen in Europe. He adds that prices remain firm at the moment and it does not look like nitrogen will be more expensive than in 2019.

He sees stronger environmental regulations as a driver for business opportunities. “Agriculture is a major source of greenhouse gas emissions and solutions will be needed to combat soil degradation, and nutrient losses to water and air,” according to Morrison. He says that farmers and the food industry are seeking a deeper engagement in their supply chains, and Yara is anticipating this will change how farmers buy and apply fertilisers. He believes that by using Yara’s proven low-carbon fertilisers and best farming practices, the carbon footprint from crop production can be significantly reduced, while maintaining yields.

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: