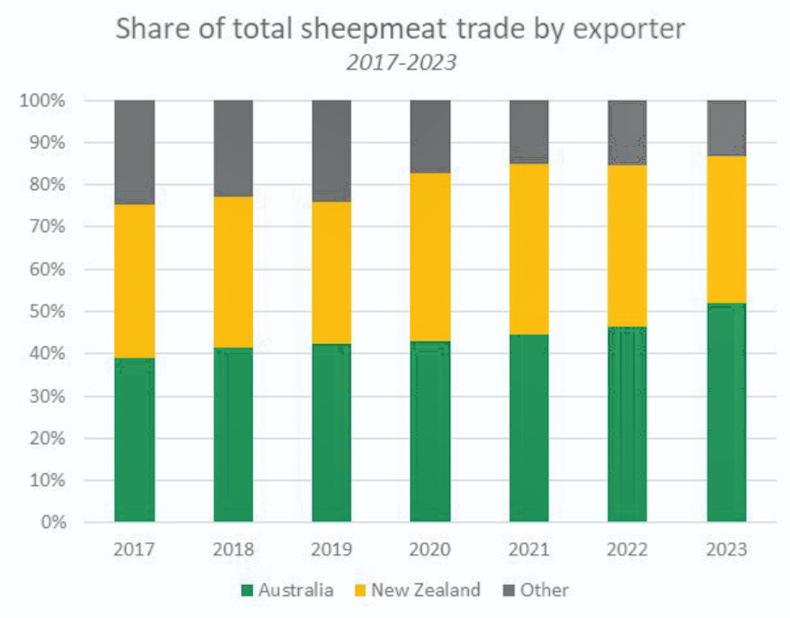

Meat and Livestock Australia (MLA) reported on Friday 5 April that Australian sheepmeat accounted for over 50% of global sheepmeat exports for the first time in 2023.

Australia’s percentage share of global exports has grown gradually from less than 40% in 2017, as demonstrated in the bar chart below.

The increase in the country’s percentage share has been underpinned by record sheepmeat production in 2023 and also to a lesser extent by sheepmeat exports from New Zealand declining in recent years.

MLA reports that the increase in exports has curtailed its competitors, with New Zealand exports particularly affected.

“New Zealand’s exports have been affected by the increase in Australian supply, leading to a decrease in their market share in China. Additionally, supply chain constraints have hindered exporters’ ability to expand market share in other key markets,” it said.

Chinese market

Sheepmeat imports in China increased by 24% in 2023 and, according to MLA, reached approximately 430,000t.

New Zealand has been the dominant market supplying China in recent years, but their exports only grew by 10% in 2023.

This translated to New Zealand accounting for 50% of the Chinese import market, down from 57% in 2022.

In contrast, Australian sheepmeat exports to China increased by 43% to 197,448t. This means that 71% of the increase in China’s imports was filled by Australia, with its market share increasing to 46% and setting a new record figure.

The increased availability of Australian lamb put significant downward pressure on New Zealand returns from the Chinese market. MLA reports that New Zealand sheepmeat exports historically held a premium of $1 to $1.30/kg over Australian product.

This premium has disappeared since 2022, with both products fighting for market share and now competitively priced, primarily influenced by fluctuations in the exchange rate.

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: